Share dilution calculator

The new total number of shares is 1000100 1100 shares. That rounds up the amount to the amount pre-investment of 125.

Dilution Formula Calculator Examples With Excel Template

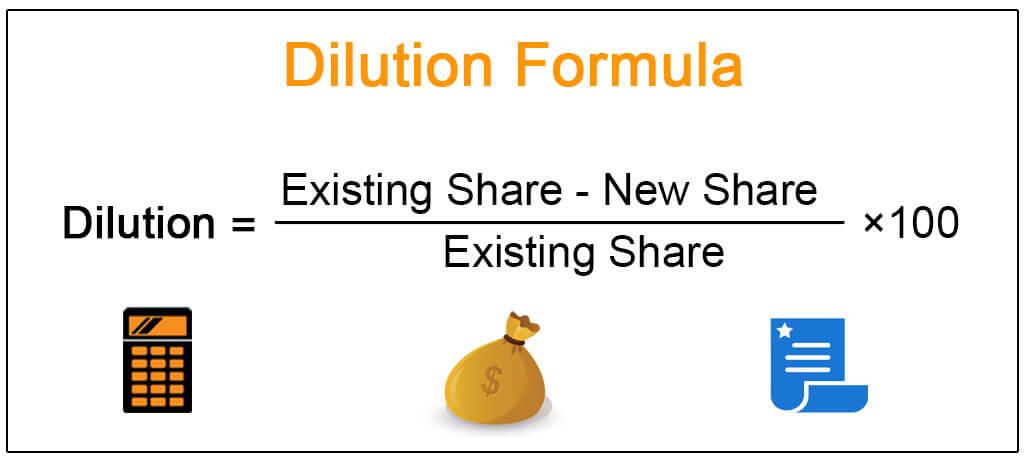

According to entrepreneur and equity thought leader Paul Graham 1 dilution can be thought of in terms of the following simple stock dilution formula.

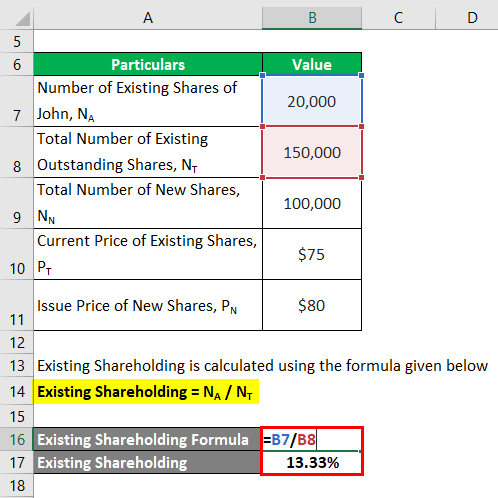

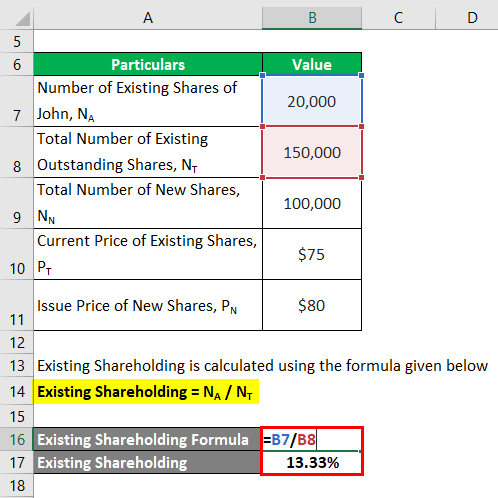

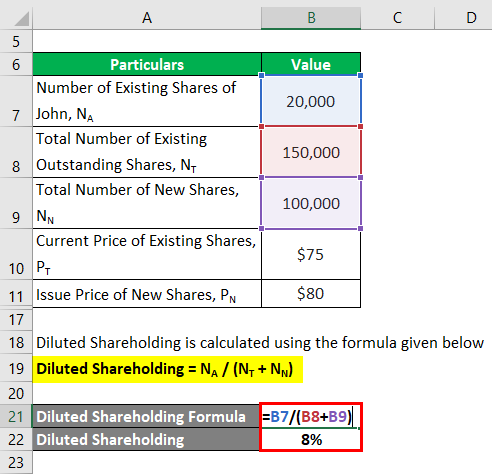

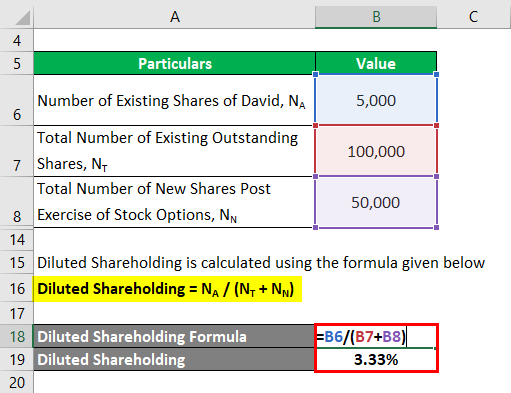

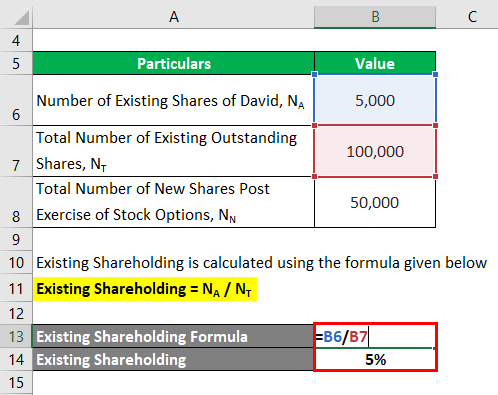

. Equity dilution calculator To use the calculator simply enter the currency the amount you are raising the post-money equity percentage you are offering to investors and the number of. Existing Shareholding 50010000 5 Whereas Diluted Shareholding is. The post-money dilution of series-a is 20 and the ESOP is 10.

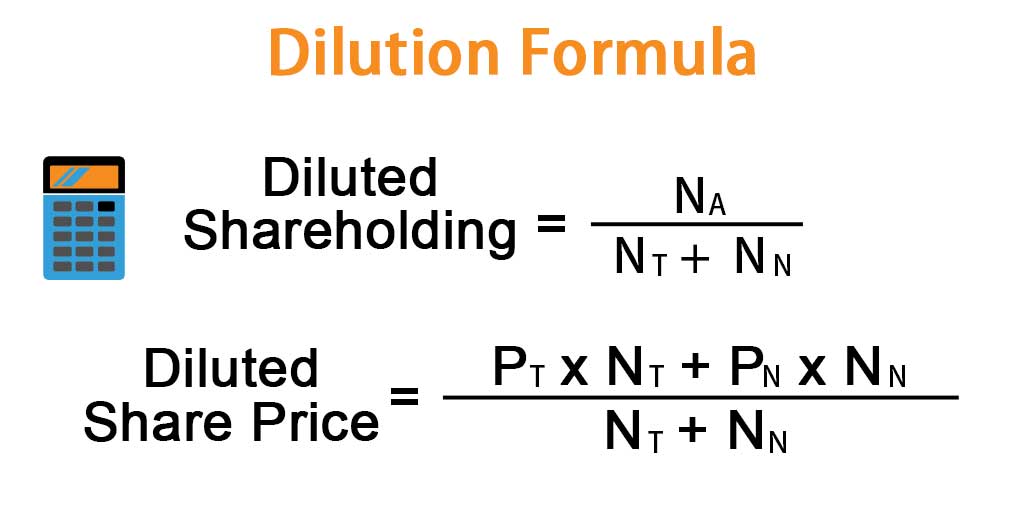

This means that each shareholder owns 1 of the. Dilution of Ownership will be. To calculate diluted shareholding we are required to calculate Existing Shareholding.

Of outstanding shares from. Once you have all the figures add them. You may have noticed that there is another toggle that determines who is diluted if there are convertible notes involved.

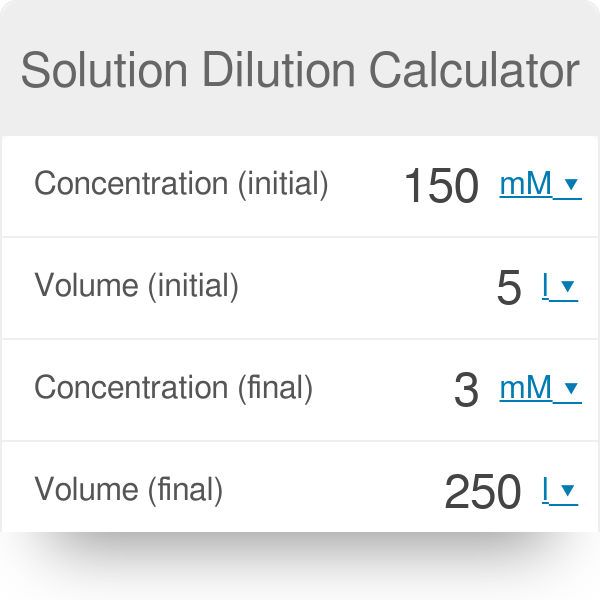

C2 is the final concentration of the diluted solution. Dilution not only affects the share. Simply we can calculate dilution in a cap table by subtracting the percentage of ownership before investment No.

Calculate Fully Diluted Shares. But what is the formula behind the. Understand the dilution formula.

Again if net income was 10000000 and 500000 weighted average common shares are outstanding basic EPS equals 20 per share 10000000 500000. Dilution affects the value of a portfolio depending on the number of additional shares issued and the number of shares held. Once you have all the figures add them.

Calculate Fully Diluted Shares. Dilution of Ownership will be. The number that you get would be the additional shares that would be there if the maximum possible dilution.

This is the volume that results after V1 from the stock solution has been. Try to calculate the difference if the Seed. Download the spreadsheet to analyze startup dilution from multiple convertible notes and SAFEs at.

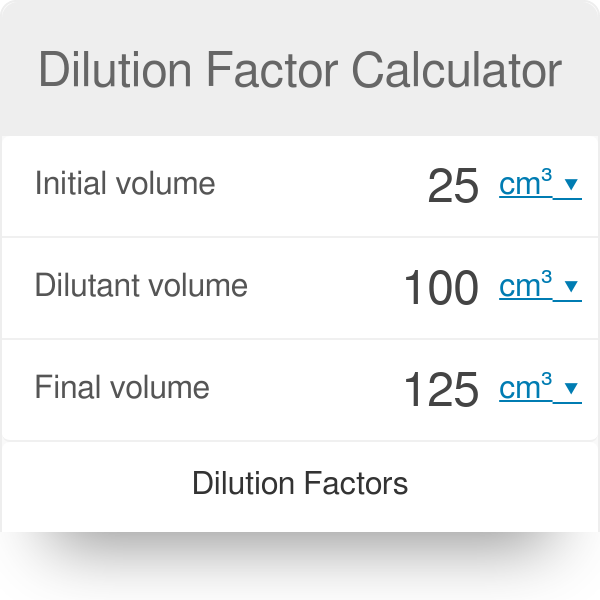

The dilution ratio is the ratio of the solute the substance to be diluted to the solvent eg waterThe diluted liquid needs to be thoroughly mixed to achieve true dilution. So you divide the 10 by 1 minus the series-a to arrive at 125 pre-money ESOP plus Advisor. Calculation of Dilution of Ownership can be done as follows.

You own 91 1000 1100 and the buyer of the newly issued shares owns 9. Value of ownership after dilution 1 n -. V2 is the final volume of the diluted solution.

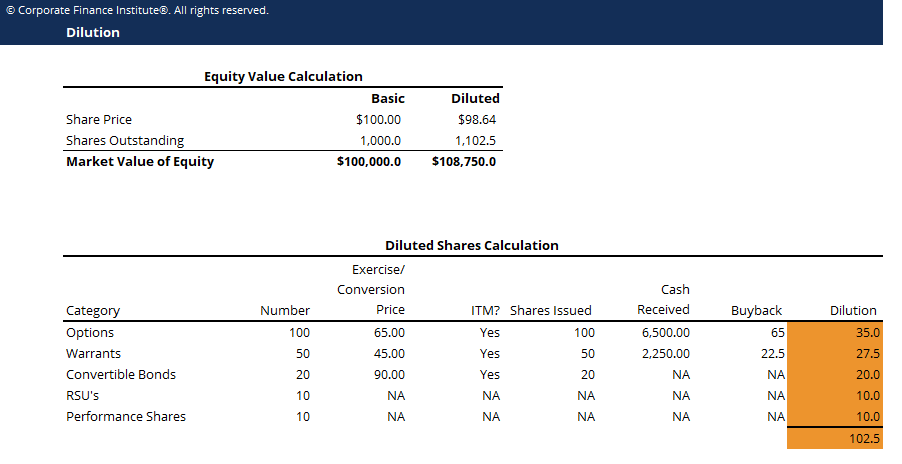

Diluted EPS 50000000 200000 15000000. Effect of Dilution. Of outstanding shares from.

Conversion Price The lower of the SAFE Price and Share Price Paid by Investors in the Priced Round SAFE Price Valuation Cap Capitalization of the Company Valuation Cap Described. The dilution at series a is 20 and the ESOP is 10. 70000 33600 7000100.

Diluted EPS Net Income Dividend on Preferred Stocks Outstanding Shares Diluted Shares Here is the workout. So you divide the 20 by 1 minus the ESOP you need.

Treasury Stock Method Tsm Formula And Calculator Excel Template

Dilution Formula Calculator Examples With Excel Template

Treasury Stock Method Tsm Formula And Calculator Excel Template

Diluted Earnings Per Share Eps Formula And Calculator Excel Template

Dilution Formula Calculator Examples With Excel Template

Capital Raise Dilution And Value Calculator Bradley Birchall

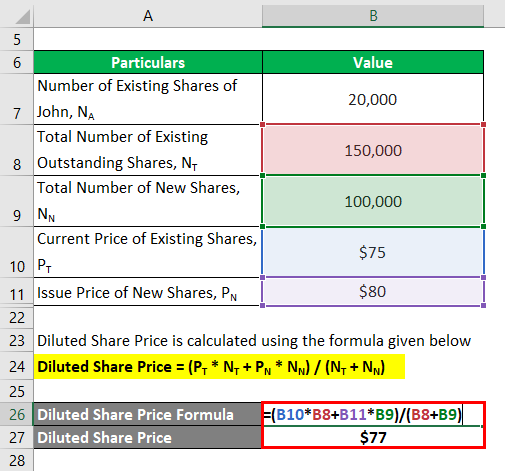

Dilutive Securities Example Of How Dilution Impacts Share Prices

Solution Dilution Calculator

How To Calculate Equity Dilution In An Investment Round Therodinhoods

Dilution Factor Calculator

/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-01-7cc050483472487f95e4bbe119e8d554.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

Dilution Formula Calculator Examples With Excel Template

Dilution Formula Calculator Examples With Excel Template

Treasury Stock Method Tsm Formula And Calculator Excel Template

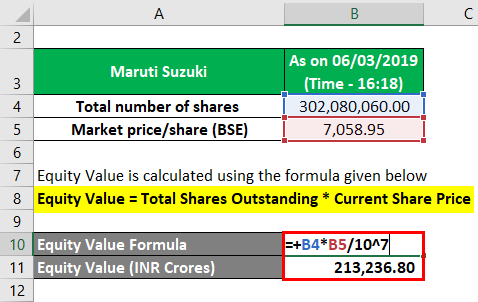

Equity Value Formula Calculator Excel Template

Dilution Formula Calculator Examples With Excel Template

Equity Dilution Meaning Formula How To Calcuate